Issuers and merchants need to be preparing for the 2015 liability shift

Boston, June 27, 2013 – Implementation in the US of EMV (Europay, MasterCard and Visa), the global standard for inter-operation of chip cards, POS terminals and ATMs, for authenticating credit and debit card transactions will cost US$10 to 11 billion for total hardware and plastics cost alone, according to research revealed today by Aite Group.

Aite Group’s research shows that a US migration to the EMV standard is no longer a matter of "if", it's a matter of "when". While some countries saw a postponement after their initial migration date was announced, U.S. merchants and issuers will not have that luxury as there are too many compelling factors driving them to the EMV standard.

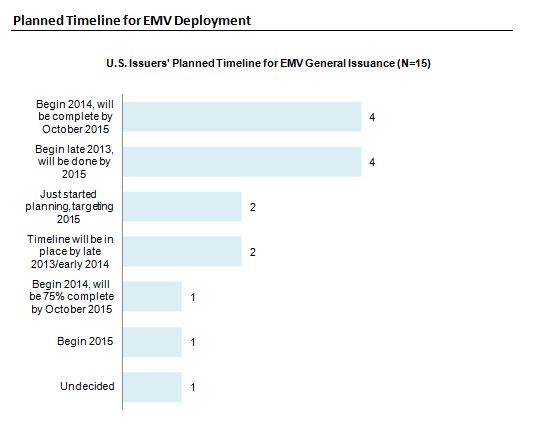

Eleven of the fifteen issuers surveyed as part of the research expect to have the majority of their portfolio migrated to the EMV standard by October 2015. Four issuers will begin issuance in late 2013, five issuers will begin in 2014, and two issuers have just started the planning process, but are working toward the October 2015 liability shift date.

“The US is by far the largest and most fragmented market to move to EMV. To compound the challenge, the networks are promoting diverging CVMs. Consumers who have been trained to expect uniform transaction processes regardless of issuer or brand will begin to have diverging experiences, depending on the issuer. This divergence will lead to confused consumers and merchants, longer queues, and the opportunity for fraudsters to capitalize,” said Julie Conroy, research director in retail banking at Aite Group.

Media contact: Marcel Kay

|